Making RBI the issuing authority will ensure that the Centre won’t enjoy the sole discretion on information use, which is possible now with SBI being the issuing authority

Making RBI the issuing authority will ensure that the Centre won’t enjoy the sole discretion on information use, which is possible now with SBI being the issuing authority

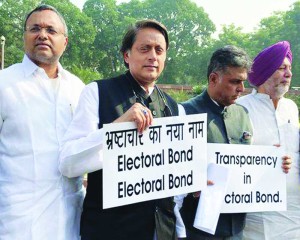

For long, widespread use of black or unaccounted money in elections has been the fountainhead of corruption. Fighting elections — be it a Member of Parliament (MP) or Member of the Legislative Assembly (MLA) or any other elected body — costs huge sums which a candidate/political party is unable to garner. Businessmen and industrialists (even other entities engaged in undesirable activities) exploit this vulnerability of candidates and political parties to give contributions, expecting good returns, either by way of favourable policies or support in other forms such as award of contracts and so on. On getting elected, the latter returns the favour. The grant of such benefit results in the generation of more black money which gets funnelled into the system, resulting in a vicious cycle of political funding on an increasing scale and intensification of corruption. The subsisting fairly liberal threshold of permitting contribution per person up to Rs 20,000 in cash has paved the way for crores to be given to political parties in cash even while keeping the identity of donors anonymous. To rein in use of unaccounted money and bring “transparency” in election funding, in its first term, the Modi Government took two major initiatives. First, based on the recommendation of the Election Commission (EC), it lowered the limit for anonymous cash donations from Rs 20,000 to Rs 2,000. Second, in the Union Budget for 2017-18, it announced an Electoral Bond Scheme (EBS) as part of the Finance Bill. The scheme was implemented from January 2, 2018. Both the initiatives have come under strident criticism. In particular, critics have targetted the EBS saying, “this has legitimised the role of black cash in elections and kept the identity of donors anonymous, even as an overwhelming share of this money has gone to the ruling party (BJP) at the Centre.”

The issue was raised in the ongoing Winter Session of the Parliament even as the Supreme Court (SC) has posted a writ petition challenging the constitutional validity of the scheme for hearing in January 2020. Meanwhile, scrutiny of the initiatives is in order. The first measure won’t make any dent. If, both the giver and receiver are determined to engage in exchange of cash, they will do so even with a lower threshold. To escape being seen as a violator, all that the receiver needs to do is to show in records 10 times more entries than it was doing earlier. For instance, a party which receives Rs 1 crore from a single donor, will show it as receipt from 5,000, donors, each giving Rs 2,000 instead of the earlier 500 entries of Rs 20,000 each.

That apart, given the circulation of currency on a mammoth scale (in the aftermath of demonetisation, though bulk of it was sucked out of the system, it is now back with vengeance) and absence of any credible mechanism to check its movement, even if the Government were to completely bar contributions in cash and insist that every single rupee has to be paid by cheque or electronic mode, even then, it won’t be possible to make any dent on use of cash. Coming to the EBS, the bond is a bearer instrument like a Promissory Note that is payable to the bearer on demand and is interest-free. The bond can be purchased by any citizen — singly or along with other individuals — or a body incorporated in India. The instrument is issued in denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh and Rs 1 crore and its sale is opened once in every quarter for 10 days, and a month ahead of general elections or as notified by the Government. They are valid for only 15 days. To purchase the instrument, the donor has to submit the Electoral Bond Application Form along with the deposit slip, citizenship and KYC documents and cheque or demand draft at any authorised branch of the State Bank of India (SBI). Alternatively, the instrument can be bought online through NEFT/RTGS visiting the SBI website. The donor can give the bond to a party of his/her choice. Only registered political parties that secured at least one per cent of the votes polled in the last general elections are eligible to receive this instrument, which can be encashed by eligible parties through accounts in authorised banks, currently only the SBI.

All parties are required to maintain accounts of receipts and expenditure and submit them to the EC. The sale of the first batch of electoral bonds took place in March 2018. For six months during 2018, SBI sold bonds worth Rs 1,056 crore. During January-March, 2019, the value of bonds sold increased to Rs 1,716 crore. The charge against the scheme is three-fold. First, it legitimises the use of black cash. Second, it lacks transparency and keeps the identity of the donor anonymous. Third, an overwhelming share of such contribution is cornered by the ruling party. The first charge is untenable. This is because a person or an entity keen to buy bonds can pay for it only by cheque or electronic transfer, implying that the amount used for the purpose has an address. It is visible to the authorities who can ask, if need be, further questions on its source and ascertain whether tax has been paid on it. When the donation is made from a known source of income through banking channels and the money is fully accounted for and legitimate, the question of legitimising it (allegedly through EBS) does not arise.

The second charge, too, is without any valid basis. The authorised bank from where the donor purchased the bonds has all the particulars viz. citizenship, KYC of the latter. Though the information is not in the public domain, this can always be accessed, if need be, by authorised agencies viz. Income Tax Department, Central Bureau of Investigation (CBI), Enforcement Directorate (ED) and so on, in criminal cases under directions of the court. Notwithstanding the above, the allegation may have to do with an objection raised by Urjit Patel, then Governor, Reserve Bank of India (RBI) vide his correspondence with the then Finance Minister, Arun Jaitley (September 14, 2017) wherein he had insisted on issuing bonds in “Demat” form only and the RBI to be the only issuing authority whereas, the Ministry wanted these to be in physical form and issued by the SBI as well.

The RBI also wanted a unique identifier and an additional security feature-based ID to be incorporated in the bond. Patel’s proposal could be a shade better as issuing a bond in Demat form ensures that the information on the buyer/donor is indestructible, unlike a physical document which can be destroyed. Besides, making RBI the issuing authority would ensure that the Government of the day would not enjoy the sole discretion regarding the use of the information — something which is possible under the present arrangement of the SBI (wholly owned by GOI) being the issuing authority.

However, just because a better option was on the table, it can’t be inferred that the dispensation put in place in any way compromises on the fundamental requirement of knowing the identity of the donor. The only safeguard is that this is not disclosed to the public, on which even the RBI did not disagree. In any case, the information can always be accessed under directions of the court. As regards the third charge, this is inconsequential as to whom a particular entity wants to donate and how much is entirely its prerogative.

Merely because one party gets a lion’s share, that fact can’t be a valid argument for lambasting the scheme. There is thus no valid reason to doubt the credibility of EBS. It helps in increasing the role of “legitimate” sources in funding elections even as authorities know who such donors are.

However, the real hard nut to crack is donation in cash which can’t be reined in by a simple act of reduction in threshold or even making it zero. It could be cracked only when people themselves minimise use of cash in their day-to-day activities. For now, that appears to be a pipe dream.

(The writer is a New Delhi-based policy analyst.)

https://www.dailypioneer.com/2019/columnists/no-cover-up-for-black-cash.html

https://www.dailypioneer.com/uploads/2019/epaper/december/delhi-english-edition-2019-12-19.pdf